The Walt Disney Company ponied up $71 billion for the acquisition of 21st Century Fox, and as of a little after midnight Eastern, the purchase will be complete.

Per a press release from The Walt Disney Company:At 12:02 a.m. Eastern Time tomorrow, March 20, 2019, The Walt Disney Company’s acquisition of 21st Century Fox will become effective. With 21st Century Fox’s iconic collection of businesses and franchises, Disney will be able to provide more appealing high-quality content and entertainment options to meet growing consumer demand; increase its international footprint; and expand its direct-to-consumer offerings, which include ESPN+ for sports fans, the highly-anticipated Disney+ streaming video-on-demand service launching in late 2019; and Disney and 21st Century Fox’s combined ownership stake in Hulu.

“This is an extraordinary and historic moment for us—one that will create significant long-term value for our company and our shareholders,” said Robert A. Iger, Chairman and Chief Executive Officer, The Walt Disney Company. “Combining Disney’s and 21st Century Fox’s wealth of creative content and proven talent creates the preeminent global entertainment company, well positioned to lead in an incredibly dynamic and transformative era.”

The acquisition includes 21st Century Fox’s renowned film production businesses, including Twentieth Century Fox, Fox Searchlight Pictures, Fox 2000 Pictures, Fox Family and Fox Animation; Fox’s television creative units, Twentieth Century Fox Television, FX Productions and Fox21; FX Networks; National Geographic Partners; Fox Networks Group International; Star India; and Fox’s interests in Hulu, Tata Sky and Endemol Shine Group. Disney and 21st Century Fox entered into a consent decree with the U.S. Department of Justice last year under which Disney will divest 21st Century Fox’s Regional Sports Networks.

Earlier today, 21st Century Fox completed the spin-off of a portfolio of 21st Century Fox’s news, sports and broadcast businesses, including the FOX News Channel, FOX Business Network, FOX Broadcasting Company, FOX Sports, FOX Television Stations Group, and sports cable networks FS1, FS2, Fox Deportes and Big Ten Network, and certain other assets and liabilities, into Fox Corporation.

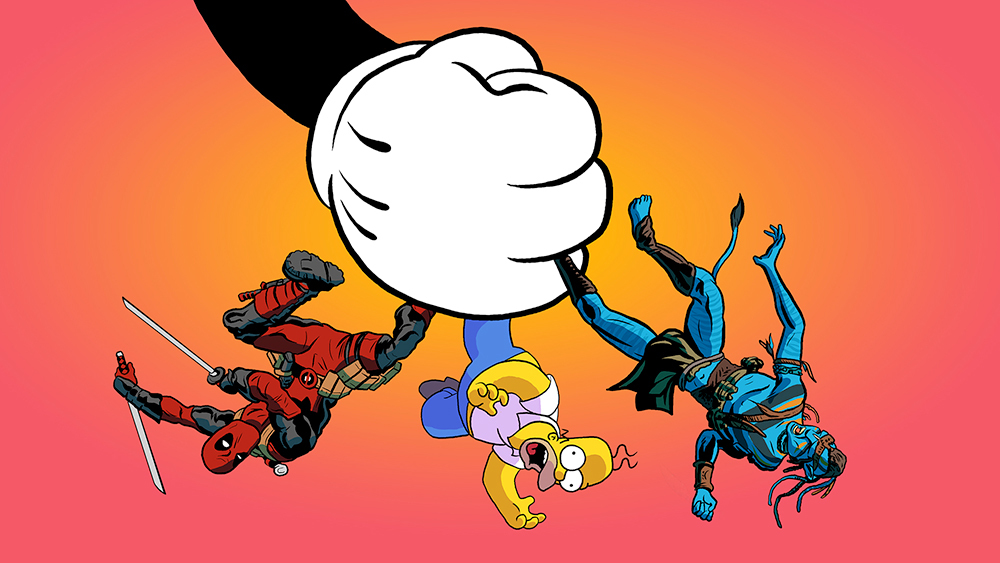

Feels like the first day of ‘Pool. pic.twitter.com/QVy8fCxgqr

— Ryan Reynolds (@VancityReynolds) March 19, 2019

Acquisition of 21st Century Fox will become effective at 12:02 a.m. Eastern Time tomorrow, March 20, 2019

Unprecedented collection of high-quality creative content, stellar talent and cutting-edge technologies will enable Disney to accelerate its direct-to-consumer strategy and expand its global presence

BURBANK, Calif. and NEW YORK, New York, March 19, 2019 – The Walt Disney Company (NYSE:DIS) and Twenty-First Century Fox, Inc. (“21CF”) (NASDAQ: TFCFA, TFCF), in connection with Disney’s acquisition of 21CF (the “Acquisition”), announced today that the per share value of the Merger Consideration (as defined below) has been calculated in accordance with the Merger Agreement (as defined below) to be $51.572626 (the “Per Share Value”). The Acquisition will become effective at 12:02 a.m. Eastern Time tomorrow, March 20, 2019.

At the effective time of the Acquisition, each share of 21CF common stock will be exchanged for $51.572626 in cash (the “Cash Consideration”) or 0.4517 shares of common stock of TWDC Holdco 613 Corp., the holding company that will own both Disney and 21CF following the Acquisition (“New Disney”) (the “Stock Consideration”, and together with the Cash Consideration, the ”Merger Consideration”), subject to election, proration and adjustment procedures set forth in the Amended and Restated Agreement and Plan of Merger(the “Merger Agreement”), dated as of June 20, 2018, by and among 21CF, Disney, New Disney, and certain of Disney’s other subsidiaries. The number of shares of New Disney common stock comprising the Stock Consideration was determined by dividing the Per Share Value by $114.1801, which was the volume weighted average trading price of a share of Disney common stock on the New York Stock Exchange over the fifteen consecutive trading day period ending on (and including) March 15, 2019.

“This is an extraordinary and historic moment for us—one that will create significant long-term value for our company and our shareholders,” said Robert A. Iger, Chairman and Chief Executive Officer, The Walt Disney Company. “Combining Disney’s and 21st Century Fox’s wealth of creative content and proven talent creates the preeminent global entertainment company, well positioned to lead in an incredibly dynamic and transformative era.”

The acquisition of 21st Century Fox’s iconic collection of businesses and franchises will allow Disney to provide more appealing high-quality content and entertainment options to meet growing consumer demand; increase its international footprint; and expand its direct-to-consumer offerings, which include ESPN+ for sports fans, the highly-anticipated Disney+ streaming video-on-demand service launching in late 2019; and Disney and 21st Century Fox’s combined ownership stake in Hulu.

The acquisition includes 21st Century Fox’s renowned film production businesses, including Twentieth Century Fox, Fox Searchlight Pictures, Fox 2000 Pictures, Fox Family and Fox Animation; Fox’s television creative units, Twentieth Century Fox Television, FX Productions and Fox21; FX Networks; National Geographic Partners; Fox Networks Group International; Star India; and Fox’s interests in Hulu, Tata Sky and Endemol Shine Group. Disney and 21st Century Fox entered into a consent decree with the U.S. Department of Justice last year under which Disney will divest 21st Century Fox’s Regional Sports Networks.

Earlier today, 21st Century Fox completed the spin-off of a portfolio of 21st Century Fox’s news, sports and broadcast businesses, including the FOX News Channel, FOX Business Network, FOX Broadcasting Company, FOX Sports, FOX Television Stations Group, and sports cable networks FS1, FS2, Fox Deportes and Big Ten Network, and certain other assets and liabilities, into Fox Corporation.

Disney is also acquiring approximately $19.8 billion of cash and assuming approximately $19.2 billion of debt of 21st Century Fox in the acquisition. The acquisition price implies a total equity value of approximately $71 billion and a total transaction value of approximately $71 billion.

The acquisition is expected to be accretive to Disney earnings per share before the impact of purchase accounting for the second fiscal year after the close of the transaction, and to yield at least $2 billion in cost synergies by 2021 from operating efficiencies realized through the combination of businesses.

Make sure to get in touch with My Mickey Vacation Travel so they can give you even more details and take all the stress out of planning to create the magic for you.

They will make sure to connect all the dots and get everything in order for your next Disney Cruise Line, Walt Disney World, Disneyland, or any Disney Destination vacation while saving you time, stress, and money.

Join the “I’m So Disney…” group on Facebook to discuss this and many other Disney things with anyone and everyone. Be sure to follow Doctor Disney on Twitter and Instagram as well.